Can I Get Title 20 If I Owe Money

Q.

How does the tax arrangement subsidize child care expenses?

A.

Working parents are eligible for two tax benefits to starting time kid care costs: the child and dependent care tax credit and the exclusion for employer-provided kid care.

Though the kid and dependent care tax credit was temporarily expanded and made refundable for 2021, it benefits only a small share of parents considering relatively few have formal child care expenses that qualify for the credit.

THE CHILD AND DEPENDENT Intendance Tax CREDIT

The child and dependent intendance tax credit (CDCTC) provides a refundable credit of upward to fifty percent of child care costs for a child under age 13 or any dependent physically or mentally incapable of self-care. Eligible child care expenses are limited to $8,000 per dependent (upward to $16,000 for two or more than dependents). After 2021, the credit will be nonrefundable and the maximum credit rate will return to 35 percent. Eligible child intendance expenses will exist express to $3,000 per dependent (up to $6,000 for two or more dependents).

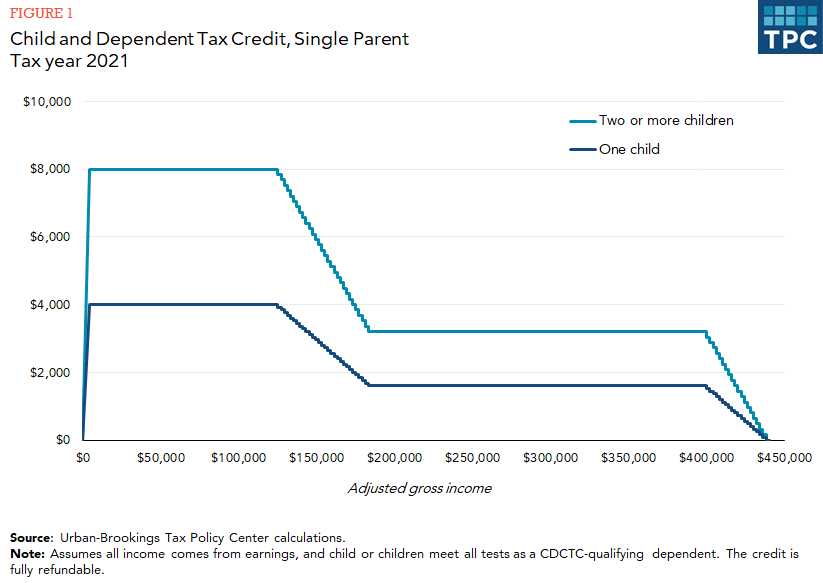

Higher credit rates apply to families with lower adjusted gross income. For 2021, in that location is a two-function phase-out for the 50 percent credit rate. Families with adapted gross income beneath $125,000 qualify for the total fifty percent credit. That CDCTC rate then falls by 1 pct point for each additional $ii,000 of adapted gross income (or part thereof) until the rate reaches xx percent (at $183,000 of income). Under the second part, the credit rate is reduced from twenty percentage to 0 percent by one percentage point for each boosted $2,000 of adjusted gross income (or part thereof) above $400,000 of adjusted gross income. The credit is fully phased out at $438,000 of adjusted gross income. Afterward 2021, only the first part of the phase-out applies, the credit rate is non reduced below 20 pct (effigy 1).

Prior to the ARP, the CDCTC was nonrefundable. That is, information technology could only be used to outset taxes owed. Under the ARP, if a family qualifies for a CDCTC that exceeds taxes owed, they can receive the deviation as a tax refund. In 2022, the CDCTC volition revert to its pre-ARP rules.

To qualify for the CDCTC, a single parent must exist working or in school. For married couples, both adults must exist working or attending school. In general, allowable expenses are capped at the earnings of the lower-earning spouse. Special rules allow individuals who are students or disabled to have their earned income assumed to be $667 per month ($one,334 if in that location is more one qualifying child).

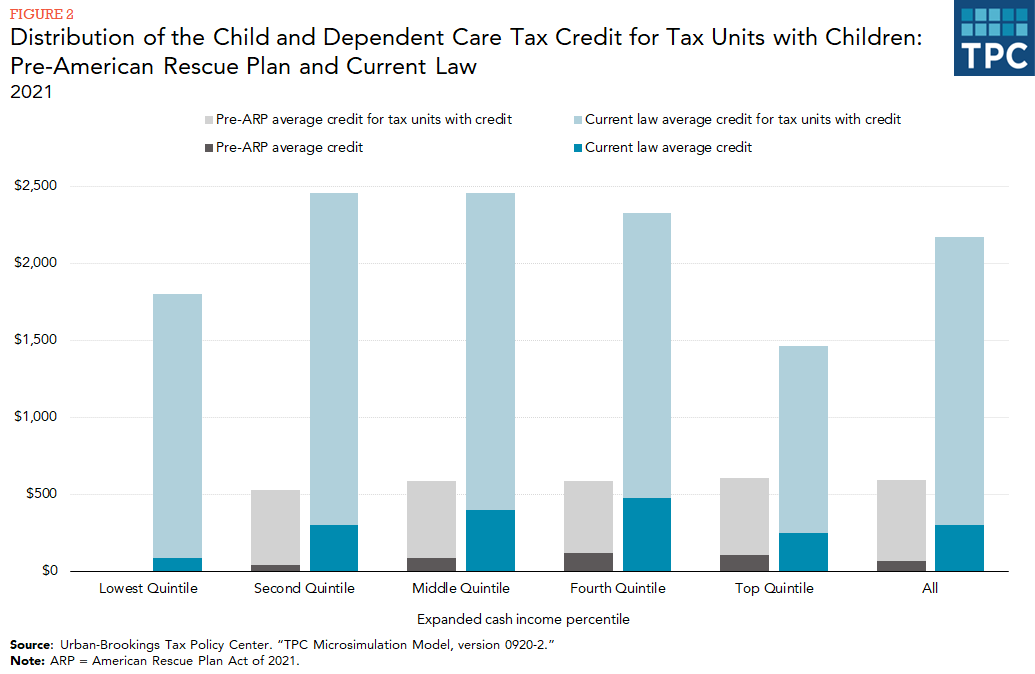

The Urban-Brookings Tax Policy Middle estimates that, in 2021, fourteen percent of families with children will benefit from the CDCTC. Nether the pre-ARP rules, 12 percent of families benefited from the credit. Some families with children will non benefit from the CDCTC because they do not have child care expenses or, in the example of married couples, only 1 partner works or goes to school.

Amidst families with children who benefit from the CDCTC, taxes volition exist reduced by an average of $2,174. Under the pre-ARP rules, the boilerplate credit among families who claimed it was $593.

Nether the 2021 rules, boilerplate benefits for the lowest and highest income quintiles are lower than those for the middle three income quintiles. Under pre-ARP law, boilerplate benefits for families in the everyman income quintile were lower than for all other income quintiles. Families in the lowest income quintile are likely to have lower child care expenses than families in college-income quintiles, while families in the highest income quintile may exist subject to the credit phase-out in 2021 (figure 1).

EMPLOYER EXCLUSION: FLEXIBLE SPENDING ACCOUNTS

Employer-provided kid and dependent care benefits include amounts paid directly for care, the value of intendance in a day care facility provided or sponsored past an employer, and, more usually, contributions made to a dependent intendance flexible spending account (FSA).

Employees tin set aside up to $10,500 (half for a married private filing separately) per yr of their salary, regardless of the number of children, in an FSA to pay child care expenses. The coin gear up bated in an FSA is not subject to income or payroll taxes. Unlike the CDCTC, though, which requires both partners in a married couple to work to claim benefits, only one parent must work to claim a do good from an FSA. In 2014, 39 percent of civilian workers had access to a dependent care FSA (Agency of Labor Statistics 2014). Lower earners are less likely to take access to an FSA than college earners (Stoltzfus 2015).

INTERACTION OF CDCTC AND FSAs

If a family has child care expenses that exceed the corporeality set aside in a flexible spending account, the family unit may authorize for a CDCTC. Families first calculate their allowable CDCTC expenses ($8,000 per child under age xiii, up to $16,000 per family). If this calculation exceeds the amount of salary set aside in an FSA, a parent may claim a CDCTC based on the divergence. For example, a family with two or more children can authorize for up to $xvi,000 of expenses to apply toward a CDCTC. If that family excluded $x,500 from salaries to pay for child care expenses in an FSA, information technology may claim the difference betwixt the ii ($five,500) as child intendance expenses for a CDCTC. The exclusion is merely available to taxpayers whose employers offer FSAs.

Neither the CDCTC nor the FSA are indexed for inflation. Thus, each year, the real (inflation-adjusted) value of benefits from the two provisions erodes.

Updated May 2021

Further Reading

Buehler, Sara J. 1998. "Child Care Tax Credit, and the Taxpayer Relief Human activity of 1997: Congress' Missed Opportunity to Provide Parents Needed Relief from the Astronomical Costs of Child Care." Hastings Women's Law Periodical 9 (ii): 189–218.

Burman, Leonard E., Jeff Rohaly, and Elaine Maag. 2005. "Revenue enhancement Credits to Assist Low-Income Families Pay for Child Care." Tax Policy Issues and Options Brief xiv. Washington, DC: Urban Plant.

Dunbar, Amy East. 2005. "Child Care Credit." In Encyclopedia of Taxation and Taxation Policy, 2nd ed., edited by Joseph J. Cordes, Robert D. Ebel, and Jane G. Gravelle, 53–55. Washington, DC: Urban Institute Printing.

Internal Revenue Service. "Publication 503—Principal Content." Accessed November 23, 2015.

Maag, Elaine. 2005. "State Tax Credits for Child Care." Washington, DC: Urban Constitute.

———. 2014. "Child-Related Benefits in the Federal Income Tax." Washington, DC: Urban Found.

Maag, Elaine, Stephanie Rennane, and C. Eugene Steuerle. 2011. "A Reference Transmission for Child Tax Benefits." Perspectives on Low-Income Working Families brief 27. Washington, DC: Urban Institute.

Stoltzfus, Eli R. 2015. "Access to Dependent Care Reimbursement Accounts and Workplace-Funded Childcare." Across the Numbers: Pay & Benefits four (1).

Source: https://www.taxpolicycenter.org/briefing-book/how-does-tax-system-subsidize-child-care-expenses

Posted by: buserhision.blogspot.com

0 Response to "Can I Get Title 20 If I Owe Money"

Post a Comment